According to a new study of global consumers, as many as 95% of drivers could opt to use voice assistants in their cars within the next three years. However, providers of the technology have some way to go before realising that level of market penetration, with half of the same potential customers currently saying they do not trust voice assistants with the security of their personal data.

With the automotive sector facing massive disruption in coming years, companies in the market are increasingly hard pressed to find new ways to improve their bottom lines. In the UK in particular, the pressure is on for firms looking to find ways to improve their value creation. The UK endured a 7% fall in car sales throughout 2018, and while Brexit was predictably cited as a cause of this, the nation’s automotive sector is unlikely to have seen the worst of that particular storm yet.

Amid this turmoil, innovation is even more essential. Automation and AI offer vast implications for engineering, production, supply chain, customer experience, and mobility services which could well help the industry combat its flagging performance. For example, half of all consumers have already indicated that they would be willing to pay a premium to benefit from owning a self-driving car in the next five years. The problem is that a number of key hurdles regarding safety and privacy need to be cleared before such technology can truly have mainstream appeal.

Further illustrating this, a new survey from Capgemini has found that three-quarters of global consumers would be willing to pay more to have Alexa-style voice assistants installed in their cars, either now or in the future. The consultancy surveyed over 7,000 consumers who had used a voice assistant inside the car as well as 300 auto executives, revealing the 95% of Capgemini’s sample expected to adopt the use of the technology permanently in the coming three years. On top of this, 37% would already be willing to pay a premium for it, while 48% might be willing to in the future.

Immediate enthusiasm for voice assisted driving was highest in India, where 68% of respondents would already be happy to shell out extra for its addition to their cars. This was more muted throughout North America and Europe, however, with over a fifth of Germans stating they would never be willing to pay a premium for in-car voice assistants. The UK was similarly reserved about the technology’s potential, but a higher 32% still admitted they would be willing to pay up for voice assisted driving in the here-and-now – representing a major opportunity to the automotive sector as it looks to buck its downward trend.

However, there is no guarantee that the apparent popularity of voice assistants will manifest as sales. Consumers are concerned about a lack of cybersecurity as the number of breaches balloon. Businesses that fail to protect their customers’ information are also falling prey to hackers, which can steal business secrets and disrupt operations. This has already hamstrung a number of innovations which ailing market sectors have sought to deploy to improve customer experience, as seen with consumer concerns about supermarkets using their data to tailor their shopping trip.

At present, Capgemini found that a massive 50% of consumers do not trust voice assistants with the safety and security of their personal data. At the same time, 48% stated that voice assistants are too intrusive and seek too much personal information. This is because drivers would not only use assistants to access car features and functions, but also control smart devices at home, order food and groceries and manage personal appointments. As a result, the voice assistant digests a lot of consumer data – suggesting that privacy fears may well outweigh the allure of the convenience such voice assistants could provide.

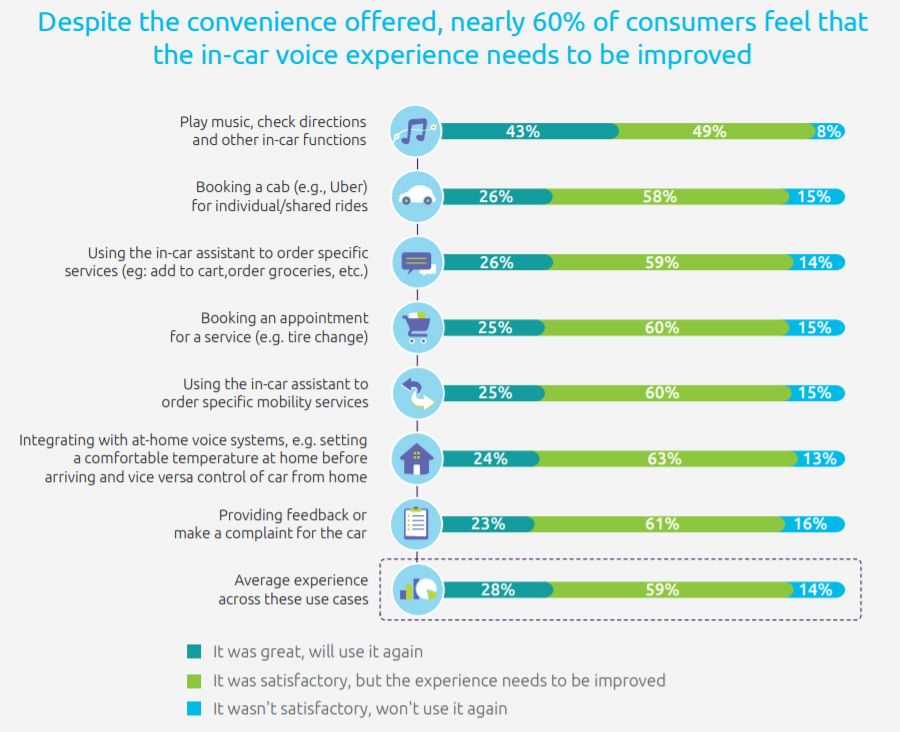

At the same time, when asked to rate their experience using in-car voice assistants, only 28% described it as “great,” with 59% agreeing that “it was satisfactory, but the experience needs to be improved.” If consumers are to pay more for such a service in future, a clear majority believe it could be improved to integrate with at-home systems such as temperature control (63%), providing feedback or making complaints (61%), ordering specific mobility services (60%) and booking vehicle service appointments (60%).

Markus Winkler, Global Head of Automotive at Capgemini, said, “This report demonstrates how the automotive industry should be using voice as a strategic asset both to build customer engagement and grow revenues with connected services over time. To make further progress, the industry needs to educate consumers about voice capabilities and data security. It must build adaptability and personalisation but also more intelligence to achieve better situational relevance and better integration between in-car and at-home voice assistants to maximise value.”