Five major challenges facing the global consulting industry

By TheWAY - 9월 27, 2019

Consulting firms play a vital role in helping businesses across fields as diverse as business strategy, manufacturing and supply chain, sales and marketing, and human resources. While the sector’s diversity means it is able to weather change like few others, a report from Deltek suggests it still faces a myriad of challenges in the era of digitalised business.

Consultancies support their clients in a multitude of ways, from helping them to formulate business models, cut costs, predict risk and innovate products, to strengthening their processes for managing talent, staying compliant and recruiting staff. Increasingly, this has involved helping clients stay ahead of the curve when adopting digital technologies, or adapting to rapidly shifting geopolitical situations. As a result, while the global economy seems to be slowing, the consulting industry continues to enjoy robust growth.

However, in spite of this growth, there are a growing number of challenges that consultants are facing. According to an industry report conducted by Deltek ‘Insight to Action – The Future of the Professional Services Industry’, consulting practices need to consider strategies for dealing with these challenges if they are to remain successful. An overview of five key challenges identified by the study.

1. Changing client behaviour

Corporate buyers of professional services have become more demanding, pushing back against concepts such as billable hours, and requiring fixed fees and with greater transparency on costs. In an increasingly agile environment, intensified by rapid digital innovation, clients now expect more value, a higher quality of work, and a faster delivery of solutions and services.

At the same time, clients are also asking for more transparency and accountability in work delivered. This particular shift in behaviour stems from the financial crisis – when companies were forced to drastically cut down on their external consulting spend – since then, they have maintained a high level of scrutiny. Clients are monitoring the value provided by consultants with greater interest than ever before.

Another factor adding to this growing scrutiny is that consulting firms no longer enjoy a monopoly on specialised knowledge. Two decades ago, firms such as McKinsey, Boston Consulting Group, and the Big Four had unique knowledge and best practice advice which made their offering invaluable. Now, much of this information is readily available online to those who are willing to research. In addition, alumni of the tier-1 consulting firms are now widespread. McKinsey alone has more than 30,000 alumni working in leadership roles across private, public and social sectors globally, meaning their expertise has been disseminated across the industry.

Thanks to these changes, clients are now more likely to spread the scope between several different providers for different tasks. By using specialist consultancies and boutique firms, clients can dive deeper into expert matters such as regulatory change, or the adoption of agile working.

So-called ‘purpose-driven’ consultancies have also become increasingly popular, amid the current climate of public scrutiny on the practices of big businesses. As a result, consultants must also be good corporate citizens themselves, demonstrating greater corporate responsibility, rather than just prioritising their bottom line. In particular, consulting firms with a history of restructuring or a focus on financial services, are often in the spotlight due to their role supporting job cuts or the relocation of clients’ profits to tax havens.

According to Deltek’s study, “the issue of unethical behaviour is now reaching a crisis point, with consumers and shareholders now agitating for change. There is a broad recognition that firms must do good.”

This is something some firms have played into already. Strategy consultancy Bain & Company, for instance, has committed to a global target of $1 billion in pro bono consulting work for worthy causes by 2025. McKinsey meanwhile established McKinsey Generation to emphasise its support to social impact. McKinsey Generation is a youth employment programme that helps young people find jobs and build careers.

2. Profitability

As clients are more willing to shop around for consulting services, they understandably hold more sway than in the past, and are demanding greater value and flexibility at lower prices. In Deltek’s survey, 54% of chief operating officers said their biggest challenge caused by “changing client behaviour” was that of providing more value at the same cost.

This has hit the margins of consulting firms, forcing consulting executives to recalibrate their own business models accordingly. Fifty-one per cent of those surveyed considered price pressure a top business development challenge over the next 12 months, and increasing profitability was a top priority for 54% of the firms surveyed, followed by managing a contracting and/or unpredictable spending environment (27%).

This margin squeeze comes at a time when overhead costs, particularly wages, continue to rise amid a talent crunch, which in turn, is resulting in the consulting practices, particularly those that struggle with efficiency or lack control of their internal operations, feeling the pressure.

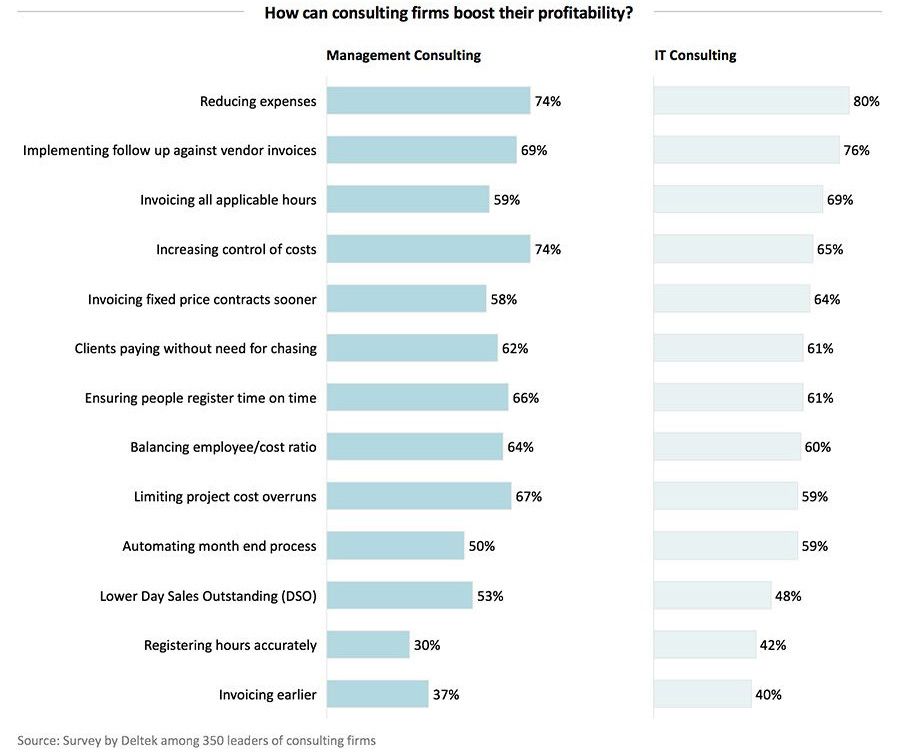

In another survey by Deltek, the researchers polled consulting executives on how they believe they could ramp up firm profitability. Increasing scrutiny on cost control ranked first, followed by improving working capital through better management of incoming and outgoing flows, and limiting the number of project budget overruns, especially in the case of fixed price projects.

3. New competition

Buoyed by innovative new technologies enabling them to do more with less, new players are entering the consulting market, and alternative, digital-savvy business structures are being deployed. In Deltek’s survey, 55% said that addressing the increasing competition in the sector was a major business priority, while 33% of chief operating officers said “defining competitive advantage” was among their top three priorities for the next five years.

Boutiques and specialist firms are not the only form of competition to be on the rise. The increase in independent consultants is also proving to be a major competitive force. In the UK, there are now over 2 million freelancers and that number will continue to grow. The largest portion of these independent consultants operates in the field of professional services, consulting and project management. They are putting pressure on prices, because they operate without the same overheads as the larger firms, and can charge well below what the established consultancies can. In the UK now, one one-fifth of the £10+ billion worth of management consulting work goes to independent consultants.

The rapid rise of independent consultants is accelerated by freelancer portals such as Upwork, PeoplePerHour, Talmix and Comatch. These portals are connecting millions of professionals globally – for example, freelancers in Southern Asia with clients in Europe. This is eliminating the need for professional services companies to act as intermediaries, which for many consultancies was a lucrative part of their incumbent business.

Elsewhere, at the top of the market, the larger players are only getting larger. The ten largest consulting firms across the globe now hold a 56% share of the industry, while the top 200 hold around 80%. Both percentages have been on the rise since the turn of the century, driven by the Big Four and the growing number of deals in the industry as a means for growth. Thanks to this, the professional services industry is seeing an increasingly ‘squeezed middle’, with firms too large to be seen as specialists and too small to compete at the top table suffering significant pressures.

At the same time, the rise of automation allows corporate buyers to handle more of their complex problems in-house. This further challenges the professional services sector, as it reduces the need to outsource. Clients are able to gain a much greater level of insight into how their profession works, either for free or at much lower prices, and can increasingly do so in real-time. Automation is also taking on more of the lower-end tasks once handled manually by professional services firms – a trend likely to continue all the way up the ecosystem.

With the rise of artificial intelligence, automation of consultancy work could become even more of a reality. Tasks performed by teams of smart junior analysts can today be carried out by a machine in the space of minutes. Celonis for instance, a German software firm specialised in process mining, is disrupting the consulting segment for process management. The firm’s software automates the identification of inefficiencies in supply chains or manufacturing processes, a job traditionally carried out by management consultants.

4. Project complexity

Consulting firms are facing an increasingly complex macro macro-environment in which they must continue to provide the best advice. The global nature of the industry adds to the problem, as firms deliver more projects overseas, in many cases also working with subcontractors, partner companies and/or independents. Delivering a project itself is not the issue – the challenge is doing so faster, more efficiently and to tighter budgets, while continuing to satisfy customer needs.

Complexity is also rising because clients are gaining better insight into their projects and demanding more control. The evolution of mobile technology has, for instance, caused a seismic shift in the sector, enabling stakeholders to gain instant access to project information on the go. It presents project managers with the challenge of staying on top of their projects within a more dynamic data environment.

Project complexity comes with a cost, too. It makes it harder for project managers to plan in advance, meaning that their resourcing volatility has gone up. It can also put a business’ bottom line at risk, with unplanned changes often required late in a project. Seventy-one per cent of respondents admitted to Deltek that they do not get paid for all change requests they have, either because the client refuses or because they decided to strategically not pass them on.

Looking ahead, over half of the consultants surveyed (52%) think the increasing complexity of projects will be the number-one challenge for project management over the next five years. Higher up in the company, 63% of executives said that project complexity is the number one top operational challenges expected in the next five years. To tackle complexity, clients need a good understanding of their projects in terms of expected costs, schedules, risk, required resources, and revenues. This allows teams to focus their resources appropriately and maximise efficiency.

5. Cybersecurity

Consulting firms handle an enormous volume of confidential client information. This ranges from strategic information (used for strategic engagements, or mergers & acquisitions) to commercial (sales & marketing information for pricing engagements) and personal data (employee data as part of reorganisation and cost-cutting exercises). Such high-value information can be very damaging if it falls into the wrong hands. That makes professional service firms obvious targets for hackers, and data breaches, therefore, pose a particularly serious threat to consultancies.

In Europe, the introduction of the General Data Protection Regulation (GDPR) – which came into force last year – put extra weight on the importance of getting cybersecurity right. In addition to incurring serious financial penalties, the negative publicity would be damaging to the businesses’ reputation and could affect their ability to win work in the future. Numerous consultancies have already suffered the consequences for failing to comply with GDPR. The result has been hundreds of thousands of pounds in fines and the loss of both current and future contracts.

Focus on key ingredients

Commenting on the five major challenges, Fergus Gilmore, Vice President Sales and Managing Director UK and Central Europe at Deltek, said, “The results of our survey reflect some concerns about the future of the consulting industry. Many feel their firms are ill-equipped to tackle current challenges and future risks, expressing a desire to strengthen core business models, as well as internal systems and processes.”

He added, “In this climate, consulting firms must focus on three key ingredients in order to gain a clear view of the risks and opportunities ahead: pipeline, projects, and people. That means knowing what kind of projects they are going to bring into the business, and when; how much it will cost to deliver those projects; and whether they have the right skills for the job. The role of technology is vital to for consultancies to get a handle on this information, and more importantly, be able to use it to inform their decision-making.”

Source : https://www.consultancy.uk/news/22032/five-major-challenges-facing-the-global-consulting-industry

0 개의 댓글