TIS and IDEMIA Join Forces to Provide Biometric Digital Identity Solutions for Financial Institutions, Using IDEMIA’s Digital Identity Platform for Research and Development

By TheWAY - 6월 04, 2018

TIS and IDEMIA Join Forces to Provide Biometric Digital Identity Solutions for Financial Institutions, Using IDEMIA’s Digital Identity Platform for Research and Development

copy. IDEMIA

COLOMBES, FRANCE-- Going forward, the two companies aim to conduct verification testing in Japan throughout 2018 targeted at financial institutions such as banks and credit card companies, amongst others, through joint research and development of highly secure and reliable biometric digital identity solutions based on IDEMIA’s digital identity and payment platform.

Biometric digital identity solutions for financial institutions are solutions that support the utilization of digital identity technologies, including biometric authentication, identity verification, and digital signatures. The incorporation of advanced digital identity technologies will enable the development of secure and convenient services for end users.

TIS has developed the brand-name of “PAYCIERGE”, based on its rich experience with development of critical systems for credit card companies and cutting-edge technologies. It has developed a broad range of services, from business systems that perform debit and prepaid card processing to mobile solutions in close proximity to the consumer for enhancing user convenience.

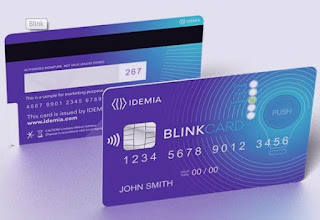

IDEMIA is the global leader in the fields of biometrics (fingerprint, facial and iris authentication), digital identity, and payment solutions. It has dozens of years of expertise worldwide, across the entire value chain in the field of Augmented Identity and provides numerous public and private markets with the most exhaustive digital trust suite (identity-verification technologies, risk-based authentication, Omni-channel online contracts, digital payments, etc.).

TIS and IDEMIA are now aiming to blend the two companies’ technologies to offer highly reliable and convenient mobile-based biometric digital identity solutions for financial institutions such as banks and credit card companies.

The following outline some of its uses:

· Enabling the opening of a bank account within just a few minutes from a remote location while maintaining regulatory (KYC*, AML*, etc.) compliance.

· Using facial authentication for secure access and performing highly-sensitive transactions (funds transfers and online payments).

· Enabling enrolment anytime, anywhere, and on any device in any type of financial product (loans, savings, life insurance, etc.) in a legally-compliant form.

TIS has been developing the new concept “PAYCIERGE 2.0” since 2016, which is adapted to the needs of the ever-evolving payments business market and offering the new solutions to this market. The linkage of the biometric authentication technology and services of IDEMIA with the financial industry experience and technologies acquired by TIS will increase the value of services in the consumer domain and create a variety of payment services with high levels of security and usability.

Pierre Barrial, Executive Vice-President of IDEMIA’s Financial Institutions Business Unit, made the following comments with respect to this joint research: “I am proud of our partnership with TIS. By combining IDEMIA’s best-in-class knowledge in ID integration and TIS’s outstanding IS integration, we can create superior value-added services for Japanese financial institutions, acquire new customers, speed up market entry, and reduce integration costs.”

Kiyotaka Nakamura, TIS Managing Executive Officer and Division Manager of the Payment Services Division of the Service Strategy Sector, made the following comments: “I am very happy that we were able to announce the research and development efforts with IDEMIA, the global leader in Augmented Identity. TIS has been developing “PAYCIERGE” solutions, but the importance of security and usability has become clear with recent progress in FinTech. We will see business innovation and market creation in the payments domain utilizing the experience and technologies acquired by TIS and the security technologies and high-usability solutions of IDEMIA.”

*KYC: Know Your Customer

*AML: Anti-Money Laundering

About PAYCIERGE

TIS retail payments solution, “PAYCIERGE”, is the comprehensive brand for retail payment solutions that provide very convenient, secure mechanisms to all customers who need to make retail payments. “PAYCIERGE 2.0” is a new concept adapted to the needs of the ever-evolving payments business market. It helps broadly with business success by incorporating reliable systems and secure operations that leverage the advanced technologies, which have an overwhelming market share in the credit card industry, and rich know-how of TIS under the theme of “connections”, which includes strengthening “connections” by making alliances, strengthening “connections” with an open API platform, and developing overseas markets.

0 개의 댓글